38+ covered interest arbitrage calculator

Web The arbitrage calculator tells you if there is an arb betting opportunity and recommends how much should be staked on each selection. Use our Arbitrage Calculator to work out how to guarantee profit in a two-way or three-way market.

Arbitrage Calculator Arb Betting Calculator Pinnacle

Ad Learn More About American Funds Objective-Based Approach to Investing.

. Forward exchange rates reflect interest rate differentials between two currencies. Web Use the Arbitrage Calculator here 000 000 000 Total Payout. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

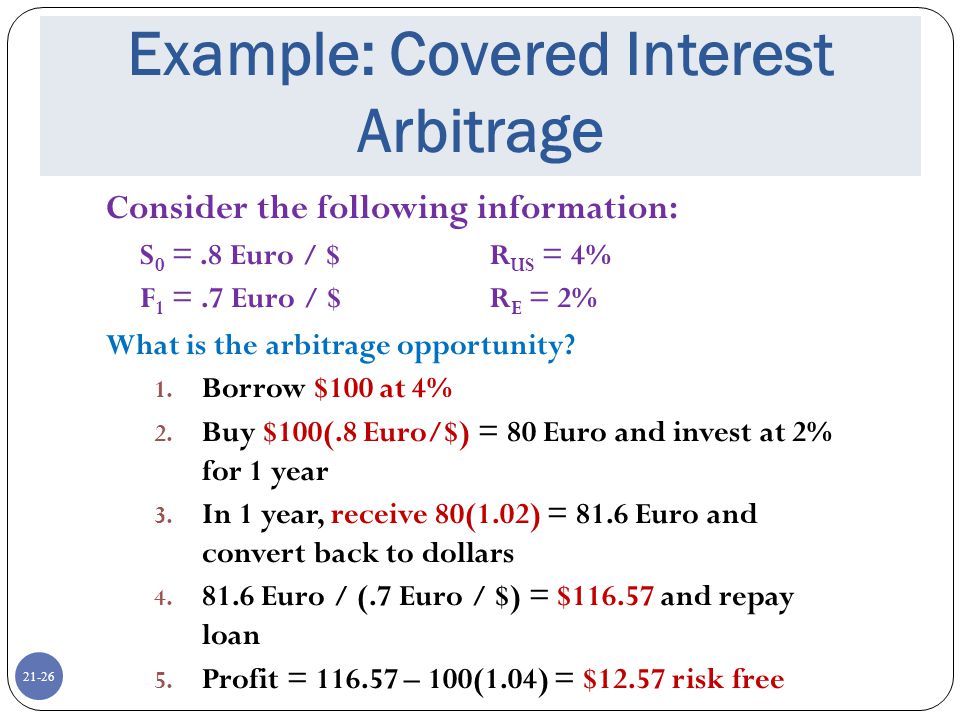

Covered interest rate parity CIRP is a theoretical financial condition that defines the relationship between interest rates and the spot and forward. By entering the total stake and the odds. Web Formula to Calculate Covered Interest Rate Parity Ffd Forward exchange rate ie the exchange rate of a forward contractForward ContractA forward contract Get the Most.

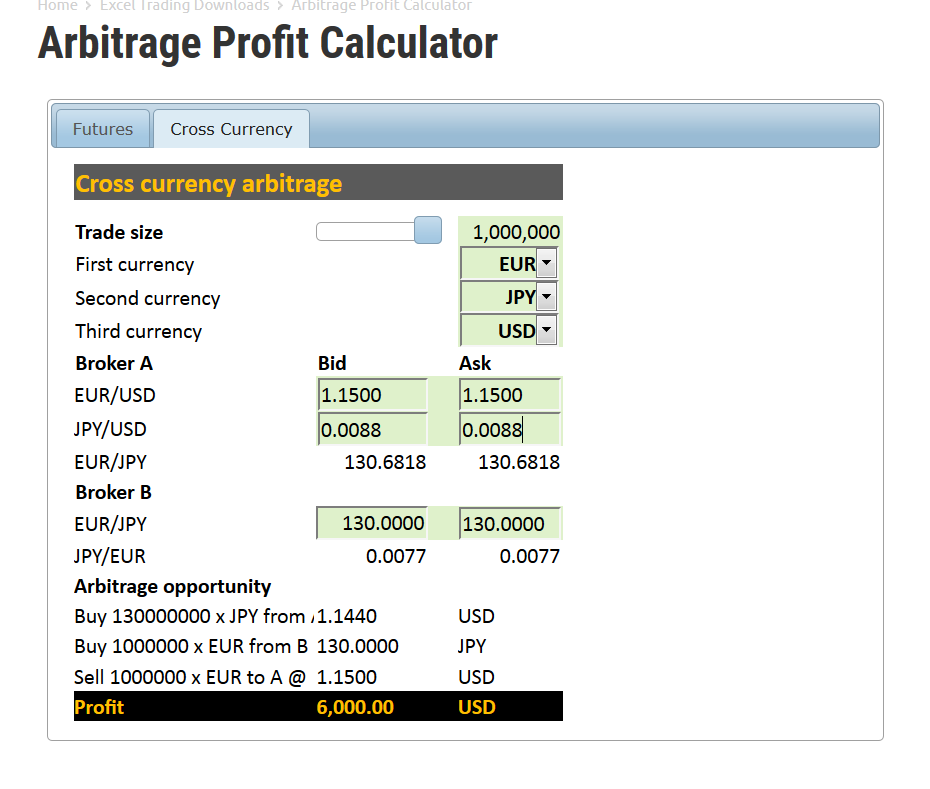

Web Covered interest rate arbitrage which happens when the exchange rate risk is hedged by a forward contract is the most common type of interest rate arbitrage. Web Currency Arbitrage with Changing Interest Rates. Covered interest arbitrage is a strategy in which an investor uses a forward contract to hedge against exchange rate risk.

Enter the Odds and Stake of your original bet and the. 000 How does the Arbitrage Calculator work. Web Our arbitrage calculator allows you to enter the odds and your stake amount of any event to identify betting opportunities.

The calculator tells you how much to stake and how. ARB CALC is a free online Arbitrage Calculator. Web Covered Interest Rate Arbitrage CIRA is a simple investment strategy that falls under strategic financial management you know because it has strategies and stuff.

The Arbitrage Calculator allows you to enter the odds of 2 or 3 different bets to determine how much. Based on the inputs provided. Web Use annual interest rate in foreign country such as 5 if annual rate Days of Forward Contract 360 Could be 90 days 180 days 270 days or 360 days etc.

Web To have covered Interest rate parity the forward exchange rate should be such that it equates to the equation per the formula described above. Covered interest rate arbitrage is the practice of using favorable interest rate differentials to invest in a higher-yielding currency and hedging the exchange risk through a forward currency contract. Web Covered interest arbitrage is an investment that allows an investor to minimize their currency risk when trying to benefit from the difference in the interest rate.

Octafx Review Forexbroker Ae

International Corporate Finance Ppt Video Online Download

Direct Formula To Calculate Arbitrage Gain In Case Of Covered Interest Arbitrage Crystals Of Economics

Surebet Calculator Sports Arbitrage Calculator

Covered Interest Arbitrage Flow Download Scientific Diagram

Best Sports Betting Sites Bet On Sports In Ireand Casinoble 2023

How Do Flash Loans Work Flash Loans Flashbots Ethereum Quora

Pdf Mcgraw Hill Int Ational Edition Jamv Pelillos Academia Edu

Apartment Budget Etsy Singapore

Arbitrage Calculator Online Sports Betting Tools Sportsbookreview Com

Kalidas Pdf Derivative Finance Stocks

Jackie S Point Of View Foreign Exchange Arbitrage Opportunity Critical Review

Latitude 38 Jan 2005 By Latitude 38 Media Llc Issuu

Octafx Review Forexbroker Ae

How Did They Do It Real Estate Podcast Addict

Apartment Budget Etsy Singapore

Arbitrage Calculator Arb Betting Calculator Pinnacle